Demand Eases, Rent Growth Slows

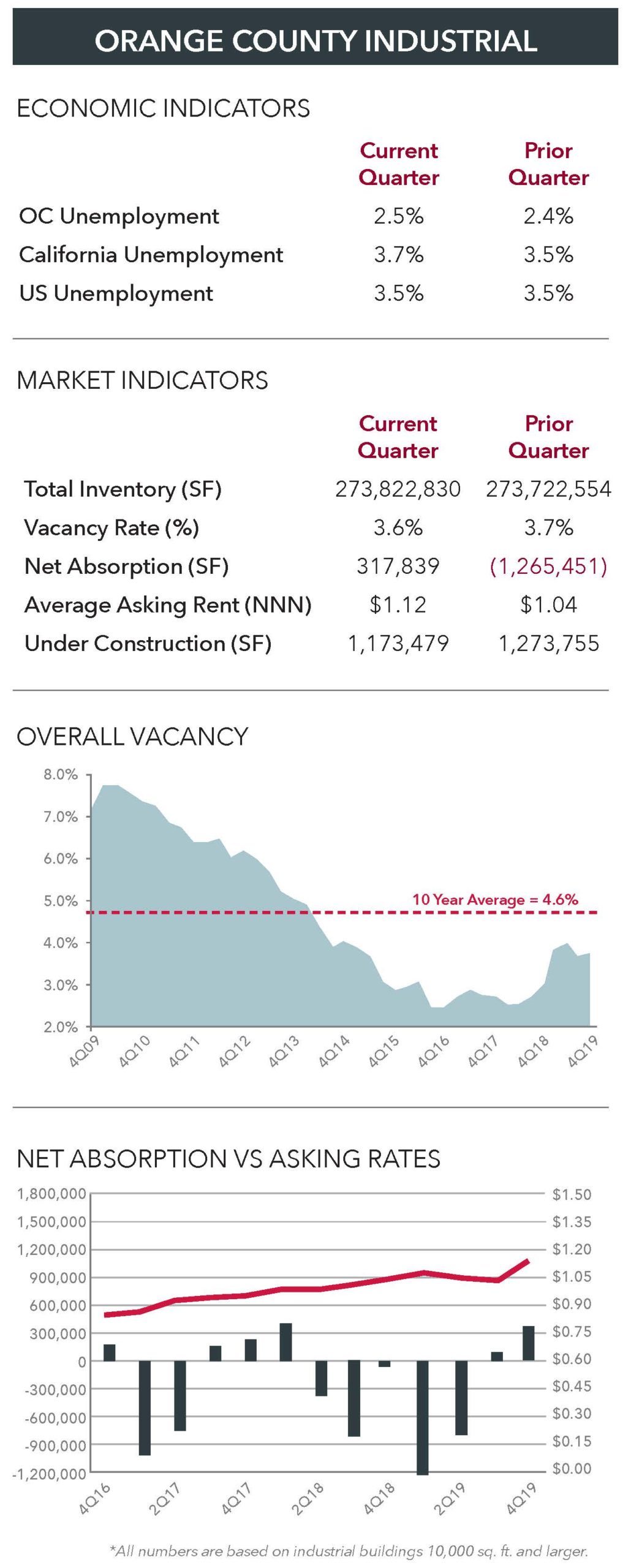

Despite healthy fourth-quarter growth from nearly 318,000 SF of net absorption, demand for Orange County industrial space in 2019 ended in negative territory for the third straight year and rents grew at their lowest rate in five years.

Despite healthy fourth-quarter growth from nearly 318,000 SF of net absorption, demand for Orange County industrial space in 2019 ended in negative territory for the third straight year and rents grew at their lowest rate in five years.

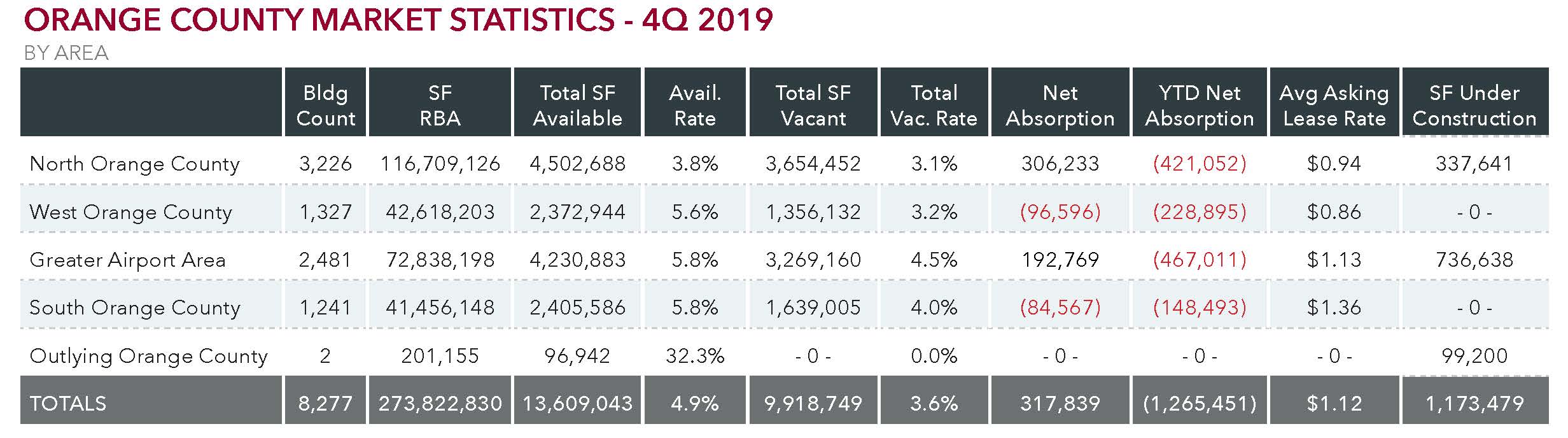

Net absorption for the year was negative 1.26 million SF spread across the county’s four markets – North, South, West and Airport – that virtually are built-out with 273.8 million SF of space. That follows negative absorption totals of 1.55 million SF and 1.14 million SF in the previous two years.

Average asking rents gained 5.8% in 2019, down from the 9.5% average annual increase since 2015.

The countywide vacancy rate has ticked up 1.1 percentage points from 2016’s all-time low of 2.5%. Nevertheless, Orange County remains one of the nation’s tightest industrial markets. Even at the depths of the slump in 2010, vacancy peaked at 7.5%. By 2014, however, more than 10 million SF of space had been absorbed, pushing the vacancy rate below 4%. Most of the remaining available space is functionally obsolete and unsuitable for most uses.

Leasing activity has been declining. There were 11% fewer deals in 2019 than the previous year and the 421 lease transactions executed in the fourth quarter are the fewest since mid 2008.

Additionally, many industrial users rely on the ports of Long Beach and Los Angeles for finished goods, parts and raw materials. Container traffic through Long Beach was down 7.8% in 2019 and down 12.4% through the Port of Los Angeles.

In the 72.8-million SF Airport market, tenants shed 467,011 SF of space in 2019, pushing up the year-end vacancy rate 20 basis points to 4.5%. Although there was 192,769 SF of growth in the fourth quarter, it was the first quarterly absorption gain since Q2 of last year.

In the North County market – the county’s largest – 486,555 SF of positive second-half growth was more than offset by 1.73 million SF of negative absorption for the previous six quarters. Rent growth in the 116.7-million-SF market slowed to 2.2% in 2019 compared to the 11.5% annual average since 2015.

The year-end vacancy rate in the 42.6 million SF West County market was 3.2%, up 30 basis points year over year on 228,895 SF of negative net absorption. After averaging 10.7% annual growth from 2015 to 2017, rents increased 1.2% in each of the last two years.

Negative absorption totaled 150,493 SF in South County in 2019 and rent growth was flat. Only six of the last 16 quarters have ended with positive absorption.

Q4 ORANGE COUNTY INDUSTRIAL MARKET REPORT FORECAST

Cal State Fullerton’s survey of local business executives found that 56% expected to see sales growth in their industry in the fourth quarter compared to 49% at the end of the previous quarter.