Amazon and the State of Industrial Real Estate

Since 2013, the rise of e-commerce has caused such an enormous boom in industrial real estate that it has become the preferred asset class of many commercial real estate investors. At the heart of the e-commerce revolution has been Amazon. Even before the pandemic, the firm had around 192 million square feet of warehouse, data center, and distribution space across the U.S. and Canada. Since the pandemic, it has added over 220 million square feet of industrial space to its portfolio.1 So it’s not surprising that many within the industry were more than a little anxious when Amazon declared that it was going to “throttle back on its e-commerce operations.”2 Why is Amazon changing its e-commerce operations and its strategy toward industrial real estate? And what does it say about the industrial sector going forward? This report will explore these questions and contend with five points that clarify the current state of industrial demand.

AMAZON IS THE DOMINANT E-COMMERCE RETAILER WITH 39% MARKET SHARE, BUT ITS GROWTH RATE SLOWED IN 2021 AND 2022.

According to a market research firm, Insider Intelligence, Amazon has the largest share of online commerce, about 39%. But its growth in the segment has plateaued. The tech giant reported its slowest sales growth in roughly two decades. Product sales have flatlined and revenue at its main online-shopping business segment has stagnated for six months, one of the worst periods of anemic growth in Amazon’s history. For years, Amazon managed to increase its share of U.S. e-commerce as the company grew rapidly, widening its lead over competitors. However, its market share grew by just 0.2% in 2021 and 2022, the slowest rate in years. That said, Amazon has said that it expects its overall performance to rebound by the end of 2022.3

AMAZON IS “NO LONGER CHASING PHYSICAL OR STAFFING CAPACITY.”

In its quarterly earnings calls4, Amazon reported that excess capacity cost the company about $2 billion in “incremental costs” during the first quarter. As a result, Amazon also reported a $3.8 billion net loss - its first quarterly loss since 2015. By comparison, this time last year it had a quarterly profit of $8.1 billion. Accordingly, Amazon has halted leasing any more industrial property for the year. In March, Amazon exited a deal in West Covina, California, for a 177,500 square foot property, where it had already signed a 12-year lease. In the San Francisco East Bay, the company recently subleased a 300,000-square-foot facility. Furthermore, Amazon plans to sublease at least 10 million square feet of warehouse space, possibly triple that amount over time. Consequently, property owners in markets such as Atlanta, New York, New Jersey, and Southern California5 should prepare to face new competition from Amazon as well as deal with the flood of new supply from developers responding to the strong demand for industrial space. About 400 million square feet of new industrial development is expected to deliver to the market in 2022.6

AMAZON HAS CHANGED ITS RELATIONSHIP WITH DEVELOPERS: IT’S NO LONGER PRIMARILY A TENANT AS MUCH AS A BUYER AND DEVELOPER IN ITS OWN RIGHT.

Currently, Amazon has five main types of distribution and warehouse facilities in its network: massive sorting facilities that tend to be more than 3M SF and multiple floors; non-sorting fulfillment centers that exceed 1M SF; inbound and outbound cross-dock facilities between 300K and 600K SF each; and last-mile facilities that can be upward of 250K SF but are close-in to major population centers.

In the past, Amazon bought and leased such facilities from developers. However, since the end of 2021, Amazon has changed its strategy. It now buys land and develops its own sites. According to The Wall Street Journal, Amazon holds $57.3 billion worth of land and buildings—more than any other U.S. public company except Walmart.7 In the last two years, Amazon has reportedly spent more than $2B on property acquisitions. The acquisitions span land, offices, warehouses, and shopping centers. Combined, Amazon’s purchases total over 5,000 acres. Four hundred of those acres were purchased in Q2 2022.8

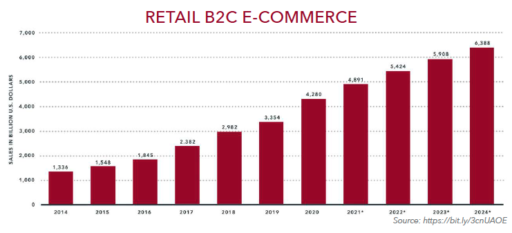

AMAZON’S CHANGING STRATEGY WITH REGARD TO E-COMMERCE DOES NOT IMPLY THAT E-COMMERCE IS DWINDLING. IN FACT, E-COMMERCE IS GROWING.

The Census Bureau of the Department of Commerce estimates that U.S. retail e-commerce sales for the second quarter of 2022 were $257.3 billion, an increase of 2.7% from the first quarter of 2022. Total retail sales for the second quarter of 2022were estimated at $1,778.6 billion, an increase of 1.9% from the first quarter of 2022. The second quarter 2022 e-commerce estimate increased 6.8% from the second quarter of 2021 while total retail sales increased 7.2% in the same period. E-commerce sales in the second quarter of 2022 accounted for 14.5% of total sales.9

The shift to online buying is a permanent, not temporary, change in consumer behavior. Consumers still like to shop in person, but an increasing amount of their shopping will be done online. By 2024, e-commerce is forecast to achieve 22% of total global retail sales.10

DEMAND FOR INDUSTRIAL SPACE IS STRONG. THE SECTOR IS NOT OVER-SUPPLIED WITH SPACE.

In response to Amazon’s changing industrial real estate strategy, many are concerned that the sector might be overbuilt and that there is a surplus of industrial buildings on the market. These concerns are misplaced. Even if all the speculative product currently in the development pipeline were to hit the market immediately as vacant, the national vacancy rate would rise to 6.3%, “a chip shot away from its historical average of 6%.”11 The industrial-property market remains healthy thanks to low vacancies and strong demand from other retailers and significant users such as Walmart, FedEx Corp., and DHL. In addition, rents continue to grow in most markets as many companies add warehouse capacity to stock up more goods and avoid supply-chain logjams.12 The growth of industrial demand may not be as explosive as it was in the immediate past, but it remains strong and secure for the foreseeable future.

Sources: 1 Wealth Management: https://bit.ly/3dTDRTG 2 WSJ: https://on.wsj.com/3AKj2mH 3 WSJ: https://on.wsj.com/3ANaknw 4 Amazon Quarterly Earnings Calls: Q1- https://bit.ly/3Tb8t3j and Q2- https://bit.ly/3AXbGfT 5 Bisnow and Bloomberg: https://bit.ly/3TgTAMP 6 Green Street: https://on.wsj.com/3cnNGsI 7 See WM: https://bit.ly/3PV1eJQ 8 Bisnow: https://bit.ly/3CCwsTf and Costar: https://bit.ly/3QSU8XG 9 US Census Bureau: https://bit.ly/3wv92eA 10 Trade.gov https://bit.ly/3cnUAOE 11 Bisnow: https://bit.ly/3Ph9pAL 12 WSJ: https://on.wsj.com/3wvUyv3

The information and details contained herein have been obtained from third-party sources believed to be reliable, however, Lee & Associates has not independently verified its accuracy. Lee & Associates makes no representations, guarantees, or express or implied warranties of any kind regarding the accuracy or completeness of the information and details provided herein, including but not limited to, the implied warranty of suitability and fitness for a particular purpose. Interested parties should perform their own due diligence regarding the accuracy of the information. The information provided herein, including any sale or lease terms, is being provided subject to errors, omissions, changes of price or conditions, prior sale or lease, and withdrawal without notice. Third-party data sources: The sources listed above, CoStar Group, Inc., and Lee & Associates proprietary data. © Copyright 2022 Lee & Associates all rights reserved.