Uncovering Opportunity Zones: 4 Things to Know

There has been a lot of talk about opportunity zones lately and these headlines are catching the eye of many investors eager to tap into this market. As we continue to hear more and more about these new real estate ventures, we want to ensure you know everything you need to about these opportunity zones so you can make a qualified decision on this type of investment.

What are Qualified Opportunity Zones?

Qualified Opportunity Zones were established by Congress in 2017 with the Tax Cuts & Jobs Act to promote investment in low-income areas. These opportunity zones are designated census tracts that are located in all 50 states as well as Puerto Rico. There are currently 8,700 Opportunity Zones and every major city has at least one. Opportunity Zones represent a subset of census tracts with an individual property rate of at least 20 percent and a median family income no greater than 80 percent of the area median.

What is a Qualified Opportunity Fund?

A Qualified Opportunity Fund is the driver of the investment in a Qualified Opportunity Zone. You cannot directly invest in a Qualified Opportunity Zone as these investments must be made through a Qualified Opportunity Fund, which can be organized as a partnership or a corporation. The Qualified Opportunity Fund will then make the investment in applicable Qualified Opportunity Zone investments. All you need to start one is to self-certify and fill out Form 8996 and attach it to your federal income tax return.

Are There Tax Benefits?

The tax bill created three main federal tax benefits for investors. For one to qualify, you have to realize the capital gains and re-invest that capital into a Qualified Opportunity Fund within 180 days. The first two tax benefits correlate to the original gains. First, you can defer the tax on that gain until December 31, 2026, or the time you dispose of the fund, but you have to pay.

Second, up to 15% of the gain can be excluded from tax so you may only owe taxes on the remaining 85% of the gain if you meet the specific holding period requirements. The final benefit relates to the investment in the Qualified Opportunity Fund itself. If you hold the investment for 10 years, 100% of the gain from the Qualified Opportunity Zone investment may be excluded from federal income tax.

What Kind of Investments are Covered by this Tax Bill?

The types of investments you can realize gains on and then the types of qualifying investments you can make with those gains are both covered by this tax bill. Only capital gains can be reinvested in a fund, so if you have been holding highly-appreciated stocks, you can reinvest this gain in a Qualified Opportunity Fund and qualify for the tax breaks. The funds can make Qualified Opportunity Zone investments in tangible property along with partnership interests and corporate stock of businesses running in Qualified Opportunity Zones.

The Bottom Line

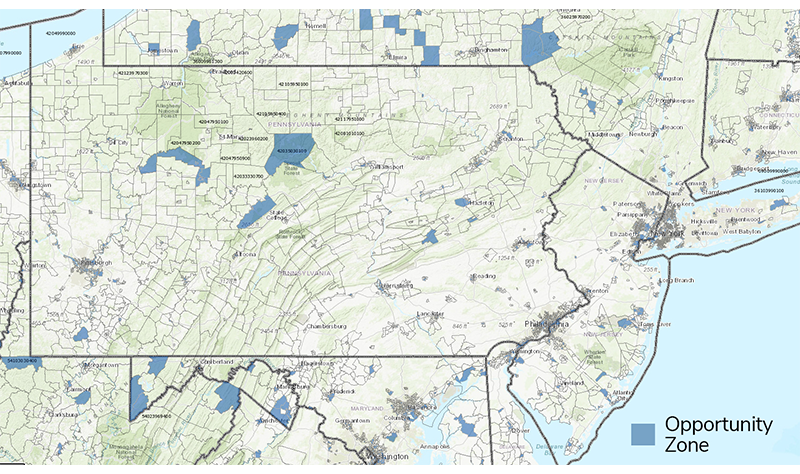

Opportunity Zones were established to encourage economic development and job creation by offering tax benefits to real estate investors to drive them to sell their appreciated investments and reinvest capital gains in areas that are in need of revitalization. Curious where you can do so in the Philadelphia Regional Market? Contact one of our knowledgeable agents today or dial: 717.695.3840.

Source: US Department of the Treasury, Community Development Financial Institutions Fund

Read More About Investments