Lee & Associates South Florida Q4 Report: Vacancies Climb in Industrial and Multifamily Sectors

Lee & Associates South Florida Q4 Report: Vacancies Climb in Industrial and Multifamily Sectors

Local office and retail markets hold steady amid broader real estate and economic headwinds...

MIAMI, FL (January 30, 2023) – South Florida’s industrial and multifamily markets saw notable year-over-year increases in vacancies, according to Lee & Associates South Florida’s Q4 2023 market report. The region’s office and retail sectors managed to keep vacancies in check, with the office market bucking national trends due to South Florida’s unique appeal from corporate tenants.

Industrial

The tri-county area of South Florida closed the fourth quarter of 2023 with a 3.1% industrial vacancy rate, up from 2.3% a year earlier. The average asking rent surged year-over-year from $14.32 per square foot triple-net (NNN) to $17.15 per square foot.

"In Q4 2023, South Florida's industrial sector demonstrated significant resilience and growth. Broward County's lease rates remained robust, particularly for tenants seeking spaces over 40,000 sf, with a notable average NNN asking rate of $17.15 per square foot annually," Lee & Associates Vice President Christian Baena said. "This period marked a continued trend of 'flight to quality,' as older properties maintained their value without significant discounts. Importantly, operating costs stabilized, benefiting from the larger property owners' ability to distribute insurance costs over extensive policies, thus maintaining higher lease rates. Despite slight post-COVID valuation adjustments, sellers' optimism persists, unaffected by looming recession threats. Overall, the market shows a positive trajectory, underpinned by a healthy balance of limited supply and strong demand, validating Florida's unique position compared to other U.S. markets.

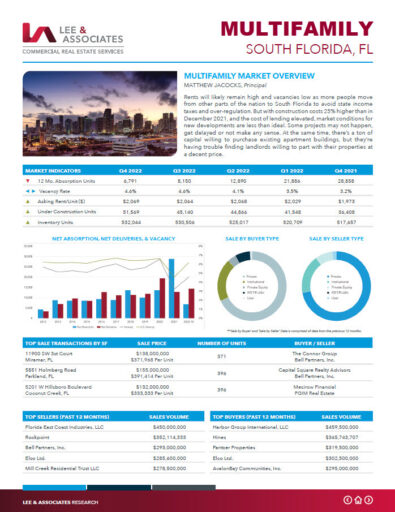

Multifamily

The local multifamily sector recorded a year-over-year rise in vacancies in Q4 of 2023, from 4.4% to 5.6%. Asking rents inched up year-over-year from $2,109/month to $2,128/month.

"Despite a recent slowdown in demand growth, South Florida's multifamily housing market remains formidable," Lee & Associates Principal Luisa Pena said. "Challenges in affordability and an extensive pipeline of 49,000 new apartment units under construction have softened market absorption. This surge in supply has led to a 1.2% rise in vacancy rates over the past 12 months, prompting developers to offer rent concessions. However, the demand for apartments remains strong due to a robust labor market and the ongoing issue of affordable housing. Rents are stabilizing and growing at a more normalized pace, although Miami continues to rank as one of the most expensive metropolitan markets. Investor interest remains high, yet the market is experiencing increasing cap rates and evolving market dynamics"

Office

South Florida’s office sector was expected to see some softening due to the national slowdown, but office vacancies declined slightly year-over-year in Q4, from 8.3% to 8.2%. The average asking rent rose from $36.04 per square foot NNN to $37.12 in the same span.

South Florida’s office sector was expected to see some softening due to the national slowdown, but office vacancies declined slightly year-over-year in Q4, from 8.3% to 8.2%. The average asking rent rose from $36.04 per square foot NNN to $37.12 in the same span.

“Miami office Market continues its steady push into 2024 with some of the best office spaces commanding rents upward of $100 per square foot," Lee & Associates South Florida Senior Vice President Matthew Katzen said. "These high rents and low vacancy rates continue to be strongest around the urban core of Brickell. Brickell has a low vacancy rate of 7% compared to Downtown Miami which is hovering at 20%. South Florida’s market average rents continued to increase to $37.12 S/F with 4th quarter of 2023 vacancy rates staying steady at 8.2%. Higher vacancies and lower rents in the suburbs by as much as 36% on average. High interest rates and other expenses including insurance and operating expense increases have contributed to a decline in office sales for 2023 (430 million) compared to 2022 (1.2 billion)."

Retail

Retail vacancies remained flat year-over-year at 3.0% in the fourth quarter. Average asking rents rose year-over-year from $35.57 per square foot NNN to $36.23.

“The South Florida retail market shows resilience amid a slowdown in leasing activity in Q4,” Lee & Associates South Florida Marketing Director, Researcher Sheena Sabatier said. “With a 12-month net absorption of 2,124,459 SF, the Tri-County region has maintained a low 3% vacancy rate and lease rates continue an upward trend, averaging $36.23/SF NNN which is up from $35.57/SF NNN in Q4 2022. Despite a slowdown in overall sale transaction volume over the past year, investor interest remains strong, driven by healthy tenant demand and limited space availability. Miami-Dade and Broward experienced modest contractions, while Palm Beach County maintains more stability, reflecting a nuanced market response to current economic dynamics and evolving investor sentiments."

South Florida Q4 Market Reports

About Lee & Associates | South Florida

Lee & Associates | South Florida is a fully vertical commercial real estate brokerage firm focused on industrial, office, retail, multifamily, investment and land sectors. Our dedicated team of professionals is led by Matthew Rotolante, CCIM, SIOR a 4th generation South Florida native in a family that has owned and operated commercial property here since 1928. Lee & Associates is the largest agent owned brokerage in the nation with Senior Agent’s ability to earn profit share resulting in the highest splits while still receiving full resources, support and leads from our national network. Our collaborative and cheerful culture allows for open communications throughout the company, fostering the sharing of information and best practices to better enable client decision making. The Lee & Associates’ robust national network that sold and leased over $32 Billion in 2022 offers clients a cross-market platform of expertise and deal opportunities across all asset specialties and representation roles. For the latest news from Lee & Associates South Florida, visit leesouthflorida.com or follow us on Facebook, LinkedIn, Twitter and Instagram, our company local news.

Lee & Associates is a commercial real estate brokerage sales, leasing and management firm. Established in 1979, Lee & Associates has grown its service platform to include over 75 offices in the United States and Canada. Lee & Associates is the largest agent owned commercial real estate brokerage where agents get the greatest return for their efforts and hence are more committed and better enabled to provide superior results for their customers. For the latest news from Lee & Associates, visit lee-associates.com or follow us on Facebook, LinkedIn, Twitter and Link, our company blog.