Creative Take on Value-Add Prospectus & Income Potential of Asset Convey The McCarren Hotel and Pool to the Market in a New Light

OVERVIEW

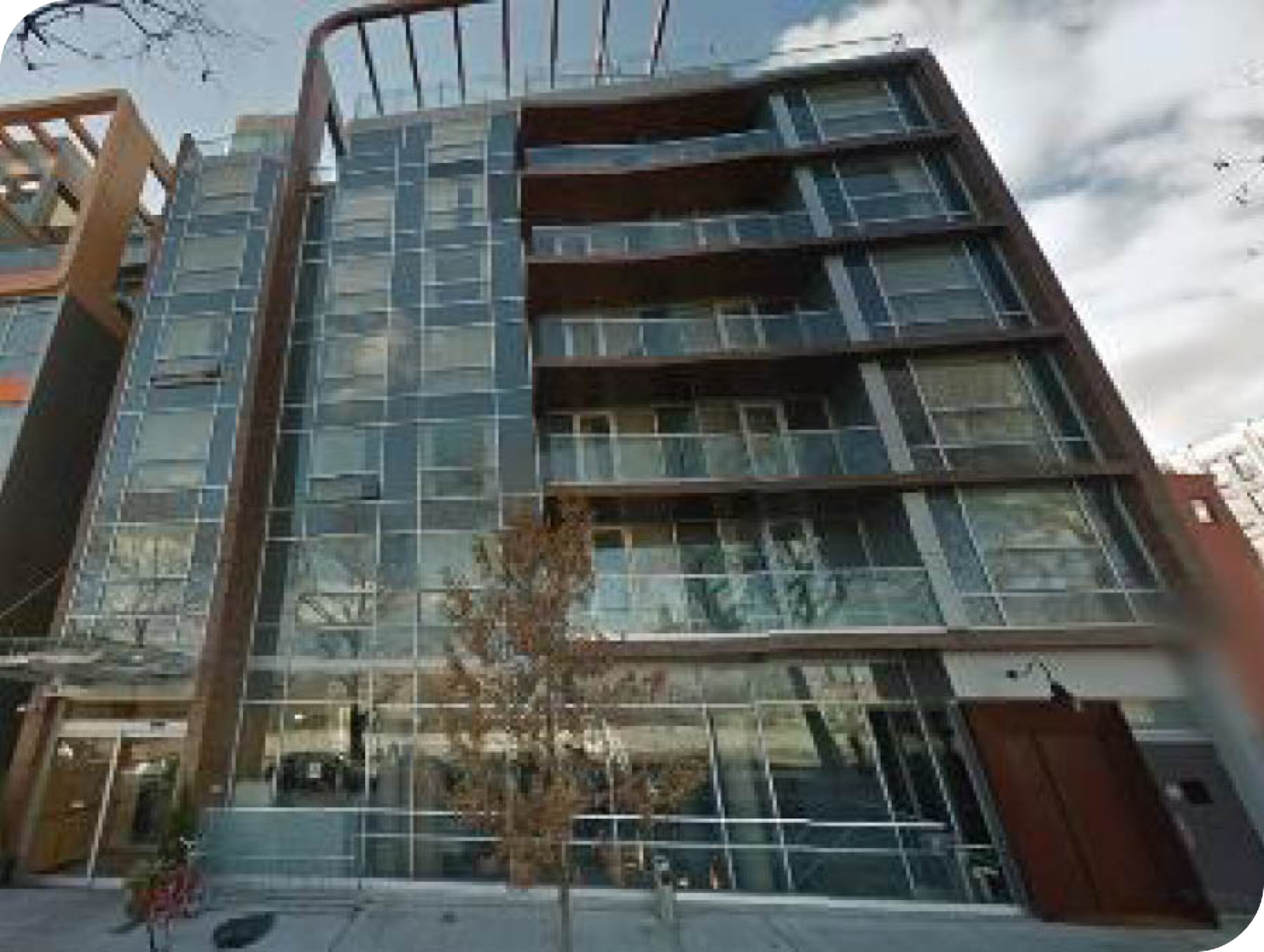

- 160 North 12th Street | Brooklyn, NY

- 64 Keys, Boutique Hotel

- ± 25,059 SF Total

- Seller Representation

- Sale Price: $22,000,000 ($878 PSF)

The Client

The client was a national private equity fund, in the final disposition of a portfolio sale of hospitality properties located throughout New York City.

The Challenge

Far from a traditional limited service hospitality asset, The McCarrren Hotel and Pool was an independent lifestyle concept. At the time of the assignment, the food and beverage program encompassing the rooftop and ground floor restaurant was losing a significant amount of money in comparison to room revenues. Despite a great location in a blossoming lifestyle market in Brooklyn, past attempts at efficiently monetizing all of the amenity space was a challenge.

Our Approach

In preparation of bringing the asset to market, the Investment Sales Team performed a complete analysis of all spaces included in the asset encompassing rooms, amenity space, and on-site parking to identify if there were any underutilized spaces that could generate additional income given highest-and-best use. An extensive financial and market analysis found that in addition to the food and beverage space, due to market demographics, the parking was underutilized on an income per square foot basis. The team formulated a business plan to convert some of the parking to expand the potential of a more expansive food and beverage concept and was able to generate close to $1,000,000 in additional income on a proforma basis after a moderate capital improvement program.

The Outcome

After a number of other brokerage teams were unable to market the property successfully, a fresh and creative take on the value-add prospectus and income potential of the asset was conveyed to the market in a new light. Focusing on existing lifestyle hospitality operators, with track records of successful food and beverage programming and partnerships, the Investment Sales Team created a competitive bidding environment for the asset. A local investment group ultimately acquired the property due to their affinity for the local market and strong belief that a fitting food and beverage program would flourish given the local demographics in this sub-market of Brooklyn.