There is a widespread myth that needs to be questioned and confronted, and it goes something like this: First came Amazon and then came COVID-19, and both killed retail. However widespread, this view of the retail market is inaccurate and incomplete. To be sure, parts of the retail sector are experiencing challenging disruptions, but other aspects of the industry are expanding and thriving. The state of the retail market is a mixed picture of disruption, change, adaptation, and success. This report will review recent consumer retail sales data from the holiday season and January, as well as explain the current state and trends within the sector.

1. In an otherwise robust holiday shopping season that started earlier in the year for most consumers, retail sales fell 1.9% in December. It was the first drop after four straight months of sales increases, though the gain in November slowed from October because of the lengthened holiday shopping season brought on by fears of product shortages and price increases.

2. Total sales for October through December 2021 were up 17.1% from a year earlier, and December sales rose 16.9% from 2020.1

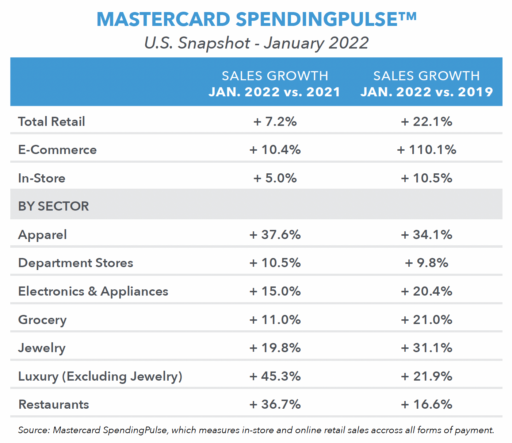

3. 2022 saw gains across nearly all retail sectors, according to Mastercard.2 Excluding auto sales, in January 2022 retail sales increased 7.2% year-over-year (YOY), with online sales growing 10.4% compared to January 2021.

4. Following the strong showing during the holiday season, key consumer trends continued in 2022. Of these trends, three, in particular, are worth highlighting:

THE SHIFT BACK TO SERVICES: The pandemic stopped a decades-long trend of more spending on services vs goods. Since the middle of last year, this tide has begun to shift back to services – or experiences – as consumers resume in-person activities. According to Mastercard SpendingPulse, Restaurant sales grew 36.7% YOY and 16.6% compared to pre-pandemic levels.

THE SHIFT BACK TO SERVICES: The pandemic stopped a decades-long trend of more spending on services vs goods. Since the middle of last year, this tide has begun to shift back to services – or experiences – as consumers resume in-person activities. According to Mastercard SpendingPulse, Restaurant sales grew 36.7% YOY and 16.6% compared to pre-pandemic levels.- E-COMMERCE SALES CONTINUE TO GROW: E-commerce sales growth shows no signs of stopping, with double-digit increases in January even compared to the strong base in 2021. Compared to pre-pandemic levels, e-commerce sales were up 110.1%, underscoring the sustained and significant nature of the shift to online retail.

- APPAREL AND DEPARTMENT STORE SALES GREW IN 2022: Apparel sales were up 37.6% in January YOY, the strongest growth rate for January in SpendingPulse history. The Apparel sector has experienced positive growth for 11 consecutive months as consumers refresh wardrobes and “dress to impress” for gatherings and events taking place in 2022. Department Stores have similarly gained from resurgent spending, with January sales up 10.5% YOY and 9.8% vs. pre-pandemic levels.3

5. The retail sector is recovering well in terms of commercial real estate trends. Last quarter, landlords filled 17 million square feet of additional real-estate space in open-air shopping centers, a 49% increase from 2019. That marks a 10-year high for net absorption. READ MORE >